city of richmond property tax rate

What is the due date of real estate taxes in the City of Richmond. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector.

Maine Property Tax Rates By Town The Master List

Get Record Information From 2021 About Any City Property.

. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. Click Here to Pay.

Car Tax Credit -PPTR. Learn all about Richmond real estate tax. Offered by City of Richmond Virginia.

What is considered real property. Real estate taxes are due on January 14th and June 14th each year. If you are looking for.

Colleen Cargo City Assessor Email Richmond City Hall 36725 Division Road Richmond MI 48062 Ph. Understanding Your Tax Bill. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

Manage Your Tax Account. Yearly median tax in Richmond City. Richmond continues to be one of the cities with the lowest residential property tax rate in the Lower Mainland.

What is the real estate tax rate for 2021. Year Municipal Rate. Paying Your Property Taxes.

Ad Searching Up-To-Date Property Records By City Just Got Easier. Ahead of the fiscal year with starts Oct. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

Per Order 21-40 The City. 107 rows Richmonds real estate tax rate is 120 per 100 of assessed value. This Department is responsible for maintaining general accounting records for the City billing and collecting Property Taxes and Fees and Permits.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Parking tickets can now be paid online. To pay your 2019 or newer property taxes online.

The city of Richmond has approved its tax rate and budget for the Fiscal Year 2022. Virginia Department of Taxation For additional forms or information on other tax related items please contact the Virginia Department of Taxation at 1-804-367-8031. The Finance Department is responsible for maintaining general accounting records for the City billing and collecting Property Taxes Fees and Permits.

Real Estate Taxes. The real estate tax rate is 120 per 100 of the properties assessed value. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

How is property tax calculated in Richmond. City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456. Building Department.

Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn. 1 the Richmond City Commission has adopted a. Due Dates and Penalties for Property Tax.

Pay Real Estate Tax. The new assessments will be used to calculate tax bills mailed to city property owners next year. Call 804 646-7000 or send an email to the Department of Finance.

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February. Search by Property Address Search property based on street address If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000. 4 rows Residential Property Tax Rate for Richmond from 2018 to 2021.

Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. Vehicle License Tax Vehicles. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in.

Pay Your Parking Violation. City of Richmond adopted a tax rate. Business License - City of Richmond Instructions for Business License Online Payments httpsetrakitcirichmondcaus Parking Tickets - T2 Systems https.

Parking Violations Online Payment. These documents are provided in Adobe Acrobat PDF format for printing.

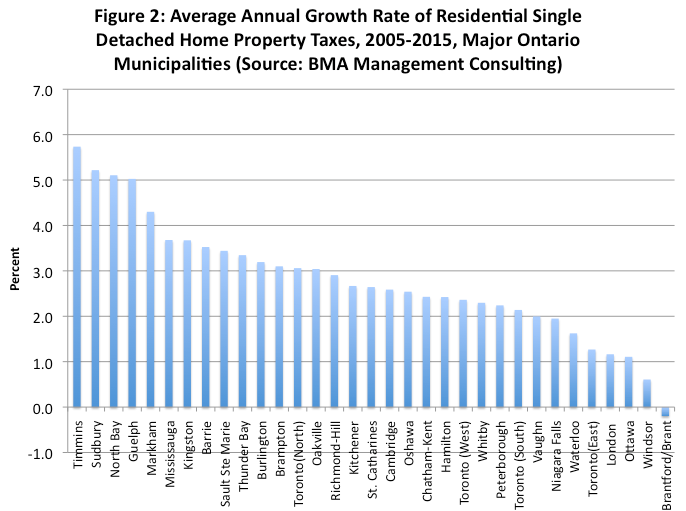

Ontarians Face Growing Property Tax Burden In Many Municipalities Fraser Institute

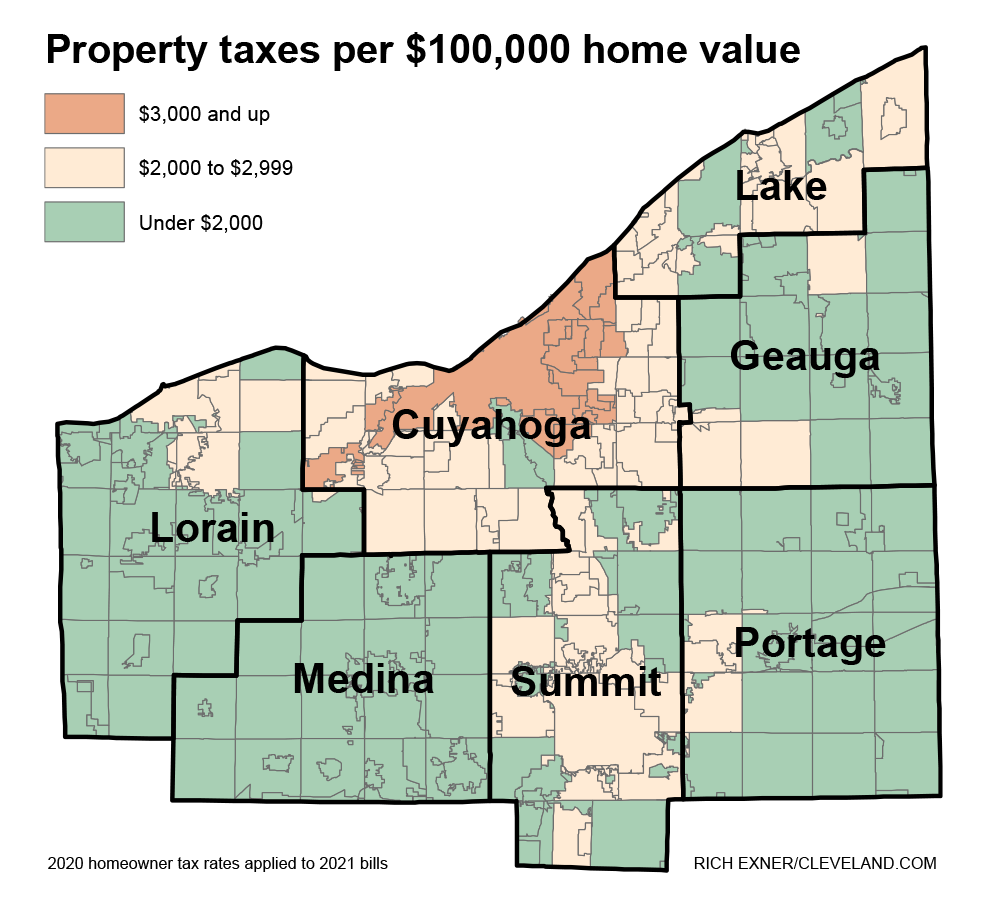

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Service After Sale The Houston Region To All Of My Buyers Request To Correct Name Or Address On A Real Property Accoun Harris County Tax Forms Accounting

Ontario Property Tax Rates Lowest And Highest Cities

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

What U S Cities Have The Highest Property Tax Rates Mansion Global

2353 Millbrook Home Buying Real Estate Kaizen

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

What Is The Property Tax Rate In Georgia Easyknock

This Ontario Resort For Sale Has 6 Villas Is Like Living On The Mediterranean Sea In 2022 Vacation Living Resort Mediterranean Sea

Kentucky Property Tax Calculator Smartasset

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Vermont Property Tax Rates Nancy Jenkins Real Estate

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now